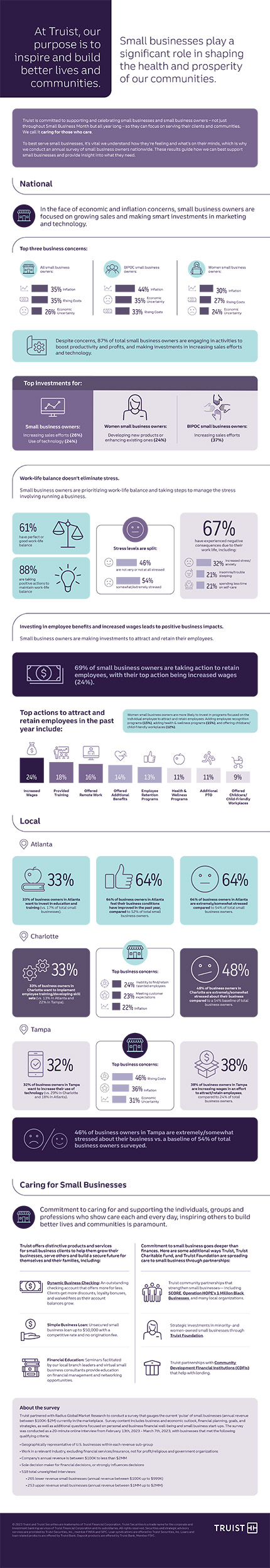

Truist's Small Business Pulse Survey indicates that while small business owners continue to navigate inflationary concerns, they are finding new ways to grow their business through investments in employees, technology, and sales practices

CHARLOTTE, N.C., May 3, 2023 /PRNewswire/ -- While small business owners continue to be concerned about inflation, they feel the future is bright and they are making smart investments in their companies, employees, and themselves, according to Truist's annual Small Business Pulse Survey 1. This year the survey uncovered the positive impact investments in technology, employee benefits, and work-life balance can have on strong business growth – even during times of economic uncertainty.

Small business owners are taking action to retain employees – from investing in employee benefits to increasing wages

In the past year, 69% of small business owners have taken one or more actionable steps to retain employees. In fact:

- 24% increased wages

- 18% provided training

- 16% offered remote work

- 14% offered additional benefits

- 13% offered employee recognition programs

- 11% offered health and wellness programs

- 11% offered additional personal time off (PTO)

- 9% offered childcare/child-friendly workplaces

Furthermore, business owners who feel better about their company's financial well-being are significantly more likely to have taken actions to attract/retain employees, and women-owned businesses are more likely to offer programs focused on the individual employee – investing back into the people who show up for the business every day. This includes:

|

Comparison of programs offered by small business owners |

||

|

Women-owned business |

Total business owners |

|

|

Employee recognition program |

15 % |

13 % |

|

Health/wellness programs |

15 % |

11 % |

|

Childcare/child-friendly workplaces |

12 % |

9 % |

"Our survey shows that small business owners are really investing in retaining and attracting employees. Not only can this lead to long-term growth, but it's simply the right thing to do for their employees and communities," said Scott Stearsman, head of small business at Truist. "This directly coincides with our values at Truist. We believe by demonstrating care, we can fulfill the purpose on which our company was founded, which is to inspire and build better lives and communities."

Small business owners are actively working to boost productivity and profits, with additional focus on making smart investments in sales and technology

To no large surprise, across business owners, the top three business concerns are inflation (35%), rising costs (35%) and economic uncertainty (26%). In fact, when asked specifically about inflation, 74% of total business owners said they were extremely or somewhat concerned.

However, more than half (52%) of business owners feel that business conditions have improved compared to a year ago. Fortunately, that rings true for Charlotte, North Carolina, where 60% feel business conditions have improved, and in Atlanta, where 64% feel business conditions have improved.

Additionally, small business owners are focused on increasing profits and making smart investments, with 87% of total business owners engaging in activities to boost productivity and profits. The top investments total business owners surveyed plan to make include increasing sales efforts (26%) and increasing use of technology (24%). When looking at specific groups of small business owners, top investments also include:

|

Small Business Group |

Top Investment |

|

Women |

Developing new products or enhancing existing ones (24%) |

|

BIPOC |

Increasing sales efforts (37%) |

|

Tampa, FL |

Increasing their use of technology (32%) |

|

Charlotte, NC |

Implementing employee training/developing skill sets (33%) |

|

Atlanta, GA |

Investing in education and training (33%) |

"It's promising to hear that, despite current economic conditions, small business owners are pivoting and making long-term investments in technology and sales practices to level up their companies for the future," said Stearsman. "They're planning ahead and digging in so they can continue to care for the communities depending on them."

This makes it challenging to maintain work-life balance, and while small business owners know it's important, it does not eliminate their stress

Despite the demands that come with running a small business, owners are working to prioritize their work-life balance. According to the survey, the most popular actions taken to achieve and maintain this include:

- Scheduling personal time (39%).

- Establishing and maintaining defined work hours (31%); those surveyed reported working an average of 40 hours per week.

- Creating work boundaries or setting times when they are not available (30%).

However, small business owners are still feeling stressed. In fact, 26% of BIPOC business owners and 21% of female business owners reported feeling extremely stressed in comparison to just 19% of total business owners surveyed. Additionally, 54% of total business owners reported feeling extremely or somewhat stressed, giving deeper insight into the stress levels of local business owners:

|

Small Business Market |

Stress Levels |

|

Total Business Owners |

54% reported feeling extremely/somewhat stressed |

|

Tampa, FL Business Owners |

46% reported feeling extremely/somewhat stressed |

|

Charlotte, NC Business Owners |

48% reported feeling extremely/somewhat stressed |

|

Atlanta, GA Business Owners |

64% reported feeling extremely/somewhat stressed |

Furthermore, 67% of business owners have experienced negative consequences due to their work life, including:

- Increased stress/anxiety (32%)

- Insomnia/trouble sleeping (21%)

- Spending less time on self-care (21%)

- Strain on close relationships (18%)

"At Truist we're committed to caring for those who care, and that includes our small business owners," said Dontá Wilson, chief retail and small business banking officer at Truist. "We're here to support them with the right products, resources and expertise to help them do what they do best – serve our communities and make them stronger."

Showing Care for Small Businesses

Truist offers exclusive products and benefits for small business clients to help them grow their businesses, serve others, and build a secure future for themselves and their families, including:

- Dynamic Business Checking: Clients get more discounts, loyalty bonuses, and waived fees as their account balances grow. And small business clients with a Truist One Checking (personal account) automatically qualify for the Premier Level when they link it to a Dynamic Business Checking account.

- Simple Business Loan: Unsecured small business loan up to $50,000 with a competitive rate and no origination fee.

- Financial Education: Seminars facilitated by local branch leaders and/or virtual small business consultants to provide education on financial management and networking opportunities.

The commitment to small businesses goes deeper than finances. Here are some additional ways Truist, Truist Charitable Fund, and Truist Foundation are spreading Care to small businesses through partnerships:

- Community partnerships that strengthen small businesses—including SCORE, Operation HOPE's 1 Million Black Businesses.

- Strategic investments in BIPOC-owned small businesses through Truist Foundation.

- Partnerships with Community Development Financial Institutions (CDFIs) that help with lending.

About Truist

Truist Financial Corporation is a purpose-driven financial services company committed to inspiring and building better lives and communities. Truist has leading market share in many high-growth markets in the country and offers a wide range of products and services through our retail and small business banking, commercial banking, corporate and investment banking, insurance, wealth management, and specialized lending businesses. Headquartered in Charlotte, North Carolina, Truist is a top 10 U.S. commercial bank with total assets of $574 billion as of March 31, 2023. Truist Bank, Member FDIC. Learn more at Truist.com.

About Truist Foundation

Truist Foundation is committed to Truist Financial Corporation's (NYSE: TFC) purpose to inspire and build better lives and communities. Established in 2020, the foundation makes strategic investments in nonprofit organizations to help ensure the communities it serves have more opportunities for a better quality of life. Truist Foundation's grants and activities focus on building career pathways to economic mobility and strengthening small businesses. Learn more at truist.com/foundation.

About Truist Charitable Fund

The Truist Charitable Fund is a donor-advised fund advised by Truist and administered by The Winston-Salem Foundation.

1 A 20-minute online interview from February 13, 2023 – March 7, 2023, with businesses that met the following qualifying criteria:

- Geographically representative of U.S. businesses within each revenue sub-group

- Work in a relevant industry, excluding financial services/insurance, not for profits/religious and government organizations

- Company's annual revenue is between $100K to less than $2MM

- Sole decision maker for financial decisions, or strongly influences decisions

- 518 total unweighted interviews:

- 265 lower revenue small businesses (annual revenue between $100K up to $999K)

- 253 upper revenue small businesses (annual revenue between $1MM up to $2MM)

SOURCE Truist Financial Corporation